When Two Firms Coordinate to Hide Evidence Before a Regulatory Deadline

Coordinated Obstruction, Unconsentable Conflicts, and Witness Tampering in Real Time

Document Overview

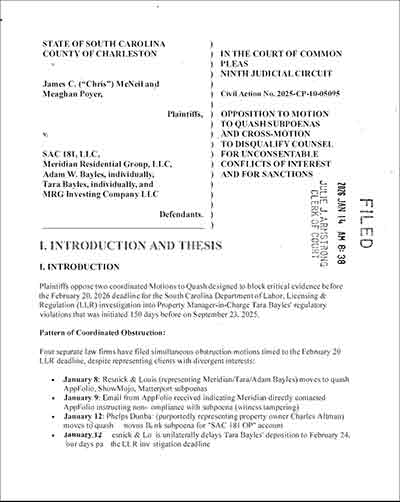

Charleston County Court of Common Pleas Case number: 2025-CP-10-05095

Filing Date: January 14, 2026

Document: Plaintiffs' Opposition to Motions to Quash Subpoenas and Cross-Motion to Disqualify Counsel for Unconsentable Conflicts of Interest and for Sanctions

Includes: Comprehensive exhibits documenting coordinated obstruction timed to block evidence before February 20, 2026 LLR regulatory deadline and an explanation behind the birth of this platform for radical transparency and systemic change towards access to housing justice for the vulnerable.

Contents: 111-page Opposition establishing three dispositive defects:- Mandatory disqualification of counsel Bolyard for irreconcilable conflicts representing Meridian's indemnity claim while quashing evidence needed for that claim;

- Phelps Dunbar's waived motion filed one day past deadline;

- Meridian's witness tampering via direct contact with AppFolio.

Executive Summary

This document was filed in response to yet another round of defense conduct triggered escalation in the case that began with what Plaintiffs characterize as a retaliatory eviction August 1 2025, followed by a late deposit return explained with a suspicious looking postmark from PMIC Tara Bayles of Meridian Residential Group, LLC.

The case escalated in late September when Plaintiffs discovered images of themselves, their belongings, McNeil's Thaut Strategic Thought Leadership brand, and the indignity of their elderly dog in diapers on multiple websites advertising the properly for rent. These images were used without Plaintiff consent or knowledge and were live for months on at least 25 websites, including high traffic sites like Zillow and Realtor.com.

The case escalated again when multiple laws firms - apparently operating under a unified "bury the pro se tenant" dictum - created multiple frivolous and/or insubstantial filingswith the court, all of which required substantial work by the Plaintiff to respond to as one person now standing up to 5 defendants, 2 large law firms, and 5 attorneys.

Then it escalated yet another level in December 2025 when Plaintiffs discovered anomalous numbers on Altman family probate property valuations and connected the dots of the $5 "flash transfer" same day LLC creation of SAC 181 upon three Altman siblings - Samuel, Arlene, and Charles (Hence "SAC") - inheriting the house at 181 Gordon Street: the house Altman's Furniture founder Israel Altman built in 1940 and lived in with his wife Edith for over 50 years.

There's more, especially when one looks at the ongoing pattern of what Plaintiffs allege to be coordinated discovery obstruction. Those are just a few escalation points to give context by illustrating the pattern.

And now this. We have what appear to Plaintiffs to be witness tampering, obstruction of a government licensure investigation, attorney conflicts of interest, and an apparent "captured client".

Through connecting the dots found during litigation discovery, Plaintiffs uncovered what appears to be a unified enterprise between a property management company, a PMIC (Property Manager-in-Charge), and the Altman family's property holding LLC that includes beneficial ownership by a public official serving on the City's affordable housing commission.

The bank account the eventually received (and partial) deposit refund checks came from has the name of that property owning SAC 181, LLC (+ "OP" as would be on an operating funds account, not a trust account holding deposits), the address of the property management company, and the signature of Tara Bayles - the PMIC under investigation by the SC Department of Labor, Licensing, and Regulation (LLR) and who is also a defendant as an individual. And the address also signifies a building that is owned by co-defendant MRG Investing Company, LLC, an entity Plaintiffs allege is merely a shell created to act as a liability shield to protect Meridian Residential Group, LLC from full accountability.

Plaintiffs allege this demonstrates shared operational control over security deposit funds and, considering the totality of evidence - is in violation of South Carolina's trust account requirements.

Then the defense coordinated to block the evidence.

The Obstruction Pattern: Timeline Proves Coordination

December 23, 2025 — Plaintiffs serve subpoenas to four third-party witnesses:

January 8, 2026 - Resnick & Louis (Meridian's counsel) files Motion to Quash targeting AppFolio, ShowMojo, and Matterport subpoenas.

January 9, 2026 - On or just before the day after filing its quash motion, Meridian directly contacts AppFolio with "formal notice", resulting in AppFolio refusing compliance.

January 12, 2026 - Two escalations occur:

- AppFolio confirms Meridian's "formal notice" has caused them to withhold responsive documents

- Phelps Dunbar, who is purportedly representing SAC 181 LLC, files Motion to Quash the Synovus Bank subpoena - one day after the 19-day objection deadline under SCRCP 45(d)(2)(B), making the motion legally waived

January 12, 2026 (morning) - The same day, counsel Bolyard delays witness Phillips' deposition to February 24 - four days AFTER the February 20 LLR investigation deadline.

February 20, 2026 - Statutory deadline for South Carolina Department of Labor, Licensing & Regulation investigation (PMIC investigation initiated September 23, 2025; 150-day deadline expires)

The Smoking Gun

This clustering of actions - all apparently timed to prevent evidence from reaching the LLR investigator before the February 20 2026 deadline - proves bad faith obstruction, not legitimate procedural concerns.

If the service defect were genuine, Defendants would have objected immediately on December 23. Instead, they waited 16-20 days for a narrow window before the regulatory deadline, then coordinated four simultaneous obstruction actions.

The Conflicts: Defense Counsel Protecting Non-Clients' License While Abandoning Their Own Clients

The Bolyard Problem: Irreconcilable Conflict

Attorney Alicia Bolyard (Resnick & Louis) purports to represent three defendants: Meridian Residential Group, LLC, Tara Bayles (individually), and Adam Bayles (individually).

Meridian's Crossclaim (filed October 9, 2025) alleges that SAC 181 LLC bears primary fault while Meridian's liability is "only secondary or passive." To zealously defend this indemnity claim, Bolyard must argue:

- SAC 181 exercised control over security deposit handling

- The "SAC 181 OP" account commingling proves unified enterprise

- Veil-piercing doctrine applies; SAC 181 liable for Meridian's conduct

The Synovus Bank subpoena seeks precisely this evidence: account control, signatory authority, operational commingling.

Yet Bolyard simultaneously seeks to quash the identical Synovus subpoena, characterizing it as an "irrelevant fishing expedition."

Bolyard cannot argue both (A) "Synovus records are essential to prove Meridian's indemnity claim" AND (B) "Synovus records are irrelevant and should be blocked" in the same litigation.

This is unconsentable conflict per se under SC RPC 1.7(b)(3). Disqualification is mandatory.

The Plaintiffs' Opposition recommends striking Bolyard's quash motion as tainted by conflicted representation while preserving Meridian's October 9 Crossclaim (which remains operative judicial admission that SAC 181 bears "primary" fault).

The Phelps Dunbar Problem: Captured Counsel

Phelps Dunbar represents SAC 181 LLC and one would assume that Charles S. Altman as registered agent is their point of contact. Yet for 32 days after Plaintiffs filed devastating evidence of a "Flash Transfer" scheme - property transferred for $5.00 as liability shield, and that beneficiary Jonathan S Altman (Charles’ nephew) served on the City’s affordable housing commission (Homeownership Initiative Commission), while their property management company Meridian Residential Group, LLC executed displacement tactics - Phelps Dunbar remained silent.

Instead, Phelps Dunbar filed a quash motion that mirrored the minimizing Meridian mischaracterization of this multiple-count, multiple aggravating-factor case as merely "a landlord-tenant dispute involving the rental of the Property and the return of the related security deposit."

Plaintiffs allege this gaslighting doesn’t describe the case, but it does provide a narrative to attempt to deflect a PMIC license investigation from looking at the evidence coming to light through this case of large scale privacy violations, retaliatory eviction of long term tenants in good standing, misrepresentation of landlord-tenant law, forgery of a USPS postmark, and more.

A competent defense counsel representing SAC 181 would have immediately responded to veil-piercing allegations. Instead, Phelps Dunbar aggressively blocked the Synovus discovery that would prove or disprove corporate separateness—while remaining silent on the Flash Transfer itself.

The Impossible Choice: Phelps Dunbar faces an irreconcilable conflict between:

- SAC 181's interest (defend against veil-piercing by proving corporate separateness)

- (Meridian PMIC/CEO) Tara Bayles' non-client interest (protect PMIC license #83633 from regulatory investigation)

By blocking Synovus records, Phelps Dunbar protects Tara's license from evidence of commingling while abandoning SAC 181's veil-piercing defense. This suggests captured counsel serving non-client Tara Bayles' interests rather than represented client SAC 181.

The Witness Tampering Allegation

On or just before January 9, 2026 - one day after filing its quash motion - Meridian directly contacted AppFolio, "formal notice" resulting in AppFolio refusing compliance with Plaintiffs' subpoena.

AppFolio's January 12 email confirms:

"We have received formal notice from our customer, Meridian Residential Group, LLC, that they have filed an objection and/or Motion to Quash the third-party subpoena. We will await resolution of our customer's objection or a court order directing compliance before releasing their associated records."

Plaintiffs contend this satisfies all elements of S.C. Code § 16-9-340 (Obstruction of Law Enforcement):

- Knowing conduct: Meridian sent "formal notice" with specific content about court filings

- Willful obstruction: Meridian's January 12 escalation (after Plaintiffs' legal challenge) proves intentional obstruction

- Hinders authorized official: LLR investigators conducting statutory PMIC investigation with 150-day deadline

- In discharge of official duty: Investigation is authorized under S.C. Code § 40-57-720

The Plaintiffs' Opposition recommends:

- Criminal referral to Charleston County Solicitor for § 16-9-340 felony obstruction

- Federal criminal referral to FBI Charleston for 18 U.S.C. § 1512(b)(3) witness tampering

The Evidence Defendants Are Trying to Hide

The "SAC 181 OP" Account: Three Alleged Statutory Violations in One Configuration

Security deposit refund checks (#1027, #1028) were issued from the "SAC 181 OP" account (Synovus Bank) with what Plaintiffs characterize as three damning characteristics:

- Signed by Tara Bayles — Meridian CEO and PMIC #83633, not a SAC 181 representative

- Bearing Meridian's office address — 8310 Rivers Ave Suite B, North Charleston, not SAC 181's address

- Designated "OP" (Operating Account) — violating S.C. Code § 40-57-136(A)(1) requirement for "trust" or "escrow" designation

Plaintiffs allege this configuration violates three separate statutory requirements:

- § 40-57-136(A)(1): Account must include "trust" or "escrow" in title. "SAC 181 OP" satisfies neither.

- § 40-57-136(A)(5): Checks must reflect account designation. No trust/escrow designation shown.

- § 40-57-136(B)(3): PMICs "may not commingle trust funds with operating money." Operating accounts by definition commingle.

Under § 40-57-136(B)(5), a PMIC who violates trust account requirements "is considered to have demonstrated incompetence to act as a broker-in-charge or property manager-in-charge."

This evidence triggers licensing discipline by the LLR and veil-piercing liability in civil litigation.

What Defendants' Coordination Reveals

When two separate law firms file simultaneous obstruction motions timed to a regulatory deadline, despite representing clients with divergent interests (Meridian with indemnity crossclaim against SAC 181, yet blocking evidence needed for that crossclaim), the pattern proves:

- Unified control of litigation strategy - Despite separate representation, all firms coordinated timing around February 20 LLR deadline

- Consciousness of guilt -Clustering of motions and witness tampering reveals Defendants recognize evidence is material and damaging

- Regulatory exposure - The coordination targets prevention of evidence reaching the LLR investigator, proving Defendants fear licensing discipline

- Systemic pattern — This is not isolated misconduct but coordinated scheme involving four firms and multiple defendants

The Regulatory Significance: February 20, 2026

The PMIC Investigation of Tara Bayles (File #2025-566, initiated September 23, 2025) has a statutory 150-day deadline: February 20, 2026.

Labor Licensing & Regulation Investigators will receive:

- Subpoena to LLR (filed January 14, 2026) seeking Meridian's complaint file and investigation history

- This Opposition Brief (filed January 14, 2026) documenting the coordinated obstruction designed to prevent evidence from reaching the investigator

- RocketsFight.org platform as searchable evidence repository enabling rapid access to supporting documentation

The LLR investigator will now understand:

- Why Defendants coordinated quash motions within 42 days of the deadline

- Why Meridian directly contacted AppFolio to block compliance

- Why Bolyard delayed witness deposition to February 24 (4 days past deadline)

- Why minimizing a multiple-count, multiple aggravating factor case that includes fraud, retaliation, forced displacement in a heat wave, privacy violations, and veil-piercing as a 'deposit dispute' serves obstruction

The Civil Litigation Significance

The Opposition establishes three dispositive defects:

- Counsel Bolyard's mandatory disqualification — Unconsentable conflicts under SC RPC 1.7(b)(3)

- Phelps Dunbar's waived motion — Filed one day late; no reconsideration without permission

- Meridian's witness tampering — Direct violation of § 16-9-340, warranting criminal referral

The Court can now:

- Strike Bolyard's quash motion as tainted by conflicted representation

- Deny Phelps Dunbar's motion as untimely waived

- Order re-service of clerk-issued subpoenas (curing procedural defects)

- Refer Meridian to Charleston County Solicitor and FBI for criminal investigation

- Refer Tara Bayles to LLR for licensing violations

For press inquiries or housing justice coordination:

Chris McNeil, Pro Se Plaintiff

Email: Click here to email with web form

Case: 2025-CP-10-05095, Charleston County Court of Common Pleas

Document Access

Opposition to Motion to Quash Subpoenas and Cross-Motion to Disqualify Counsel for Unconsentable Conflicts of Interest and for Sanctions

To Top

Unable to view the pdf on your mobile device?

Unable to view the pdf on your mobile device?

Download the PDF